40 zero coupon bond value calculator

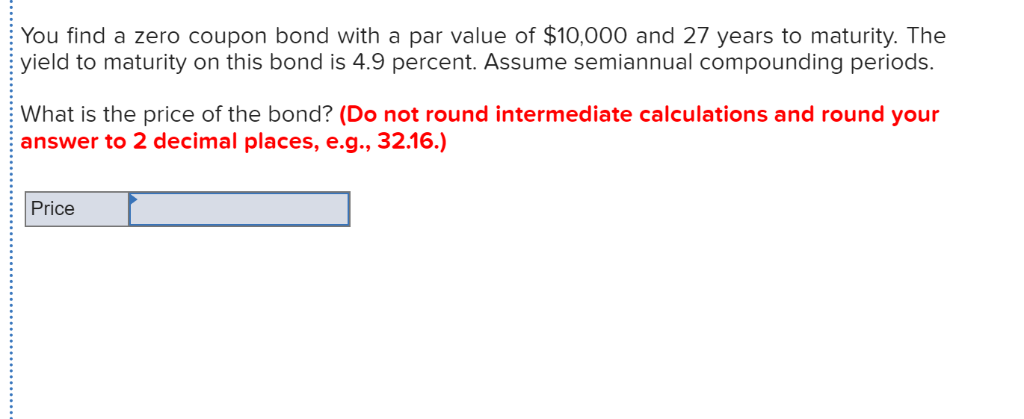

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated as: Price = M ÷ (1 + r) n where: M = Maturity value or face value of the bond r = required rate of interest n = number of years until maturity If... Zero Coupon Bond Calculator The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

How To Calculate YTM (Years To Maturity) On A Financial Calculator FV = face value of the bond n = number of years until maturity. For example, let's say you have a 10-year $1,000 bond with an 8% coupon rate. The interest payments would be $80 per year (8% of $1,000), and the face value of the bond is $1,000. Therefore, the present value would be less than $1,000 since you are effectively receiving less than ...

Zero coupon bond value calculator

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a... dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Zero coupon bond value calculator. How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond: How To Calculate Yield To Maturity Of Zero Coupon Bond In Excel Select the cell you will place the calculated result at type the formula PV B4B30B2 into it and press the Enter key. This makes calculating the yield to maturity of a zero coupon bond straight-forward. F represents the Face or Par Value. Insert the following function into B18. The formula for determining approximate YTM would look like below. ZeroCouponBond: Zero-Coupon bond pricing in RQuantLib: R Interface to ... The ZeroCouponBond function evaluates a zero-coupon plainly using discount curve. More specificly, the calculation is done by DiscountingBondEngine from QuantLib. The NPV, clean price, dirty price, accrued interest, yield and cash flows of the bond is returned. For more detail, see the source code in the QuantLib file test-suite/bond.cpp .

Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value i =... What Is Dirty Price? - thebalance.com You'd use 180 (i.e., 360 divided by two) for "T," or days between coupon payments, even though the coupon is semiannual and there are 365 days in a year. You'd calculate accrued interest as follows: Accrued interest = $1,000 x 0.05/2 x 30/180 = $4.16 To calculate the dirty price, add the clean price and the accrued interest: Quant Bonds - Zero Coupon - BetterSolutions.com Zero Coupon. For a zero coupon bond the only cash flow is the par value at maturity. There are no periodic coupon payments. The price of a zero coupon bond can be calculated using the following formula: bond price = F / (1 + r)n. What is the price of a zero coupon bond that matures in 10 years. 1) Calculate the number of periods Solved Yields: On April 1, 2022, the prices of 1-year, | Chegg.com Finance questions and answers. Yields: On April 1, 2022, the prices of 1-year, 2-year, and 3-year zero coupon US Treasury bonds with face value 100 were, respectively, 98.2318, 95.1814, and 92.5887 (a) Calculate the yields, in percent terms, of the three bonds. (b) Using the expectations theory of the yield curve, find the expected one-year in ...

› knowledge › current-yieldCurrent Yield: Bond Formula and Calculator [Excel Template] In our illustrative scenario, we’ll assume three bonds were each issued at a face (par) value of $1,000 with an annual coupon rate of 6%. Face Value of Bond (FV) = $1,000; Coupon Rate (%) = 6.00%; Since the annual coupon depends on the bond’s original face value (FV), the coupon can be calculated by multiplying the coupon rate by the FV of ... Price of a Zero coupon bond - Calculator - Finance pointers The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n Where P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [ {F/PV}]^ (1/t) =1+r Where F -face value of the bond PV- current value of the bond t -time to maturity r- Interest rate For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of $400. › glossary › zero-coupon-bondZero Coupon Bond | Investor.gov Zero Coupon Bond Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten, fifteen, or more years.

How do you calculate yield to maturity on a zero coupon bond? The target purchase price of a zero coupon bond, assuming a desired yield, can be calculated using the present value (PV) formula: price = M / (1 + i)^n. M is the face value at maturity, i is the desired yield divided by 2, and n is the number of years remaining until maturity times 2. Are zero coupon bonds affected by interest rates?

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

What Is a Zero-Coupon Bond? | The Motley Fool Zero-coupon bonds compensate for not paying any interest over the life of the bond by being available for far less than face value. Put another way, without a deep discount, zero-coupon bonds ...

Calculating the cost basis on a tax free Zero Coupon Bond A tax free zero coupon bond is issued with a yield to maturity of 3.5%. After some time, an investor buys the bond at 50. ( 50 cents on the dollar ). When he buys the bond, the bond has a yield to maturity of 3.4%. After some time, he sells the bond for 80 cents on the dollar.

Calculate the value of a zero coupon 10-year bond (semi-annual) with a ... Calculate the value of a zero coupon 10-year bond (semi-annual) with a face value of $1,000. Assume the market rate is 8%. Group of answer choices $702 - 27559892

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Use this simple finance coupon rate calculator to calculate coupon rate. AZCalculator.com. Home ... Home › Finance › Economic Benefits. Posted by Dinesh on 27-06-2021T07:56. This calculator calculates the coupon rate using face value, coupon payment values. Coupon Rate Calculation. Face Value $ Coupon Payment $ Submit Reset. Coupon Rate ...

ZERO COUPON GOVERNMENT BONDS - The Economic Times Issued at a deep discount to the face value, these bonds are non-interest bearing. This means it is an investment that does not earn any returns, but depreciates in value over the years. On Tuesday, the government notified capital infusion totalling Rs 14,500 crore through these bonds in Central Bank of India, UCO Bank, Bank of India and IOB.

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ...

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

› calculators › bondpresentvalueBond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Post a Comment for "40 zero coupon bond value calculator"