41 what is a coupon payment on a bond

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... › publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... The holder of a stripped coupon has the right to receive an interest payment on the bond. The rule requiring the holder of a debt instrument issued with OID to include the OID in gross income as it accrues applies to stripped bonds and coupons acquired after July 1, 1982.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

What is a coupon payment on a bond

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. What is coupon on bonds? - moneycontrol.com Coupon rate is calculated by taking the annual coupon payment and dividing it by the bond's face value. For instance, if you have a 10-year bonds worth Rs 5,000 having a coupon rate of 10%, then ... What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

What is a coupon payment on a bond. home.treasury.gov › policy-issues › financing-theInterest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo VerkkoThe steps to calculate the coupon rate of a bond are the following: Firstly, the face value or par value of the bond issuance is determined as per the funding requirement of the company. Now, the number of interest paid during the year is determined, and then the annualized interest payment is calculated by adding up all the payments during the ... Understanding Bond Prices and Yields - Investopedia Verkko28.6.2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? VerkkoThe term “ coupon bond Coupon Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond’s issue date to the bond’s maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more ” refers to bonds that pay coupons which is a nominal …

Coupon Payment Calculator The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called. The payment schedule can be quarterly, semiannually or annually, depending on the agreed time. When a bond is first issued, the bond's price is its face value. What is a Payment Bond? | Construction Payment Bonds | NFP A payment bond is a type of surety bond issued to contractors which guarantee that all entities involved with the project will be paid. A payment surety bond is a legal contract, a type of bond, that guarantees certain employees, subcontractors, and suppliers are protected against non-payment. Other common names for these include ... What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Bond: Definition, How They Work, Example, and Use Today A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are... Coupon Types - Financial Edge There is a special type of fixed-rate bond called a zero-coupon bond. In this case, there is no interest payment between the issuance of the bond and maturity. So, they "pay" a fixed coupon of 0%. This does not mean that there is no return for bondholders, as zero-coupon bonds are usually sold at a discounted price but repaid at 100% at ... Interest Rate Statistics | U.S. Department of the Treasury VerkkoNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from … Coupon Bond Formula | Examples with Excel Template - EDUCBA The term "coupon" refers to the periodic interest payment received by bondholders and bonds that make such payments are known as coupon bonds. Typically, the coupon is expressed as a percentage of the par value of the bond. The formula for coupon bond means price determination of the bond that pays coupon and it is done by discounting the ...

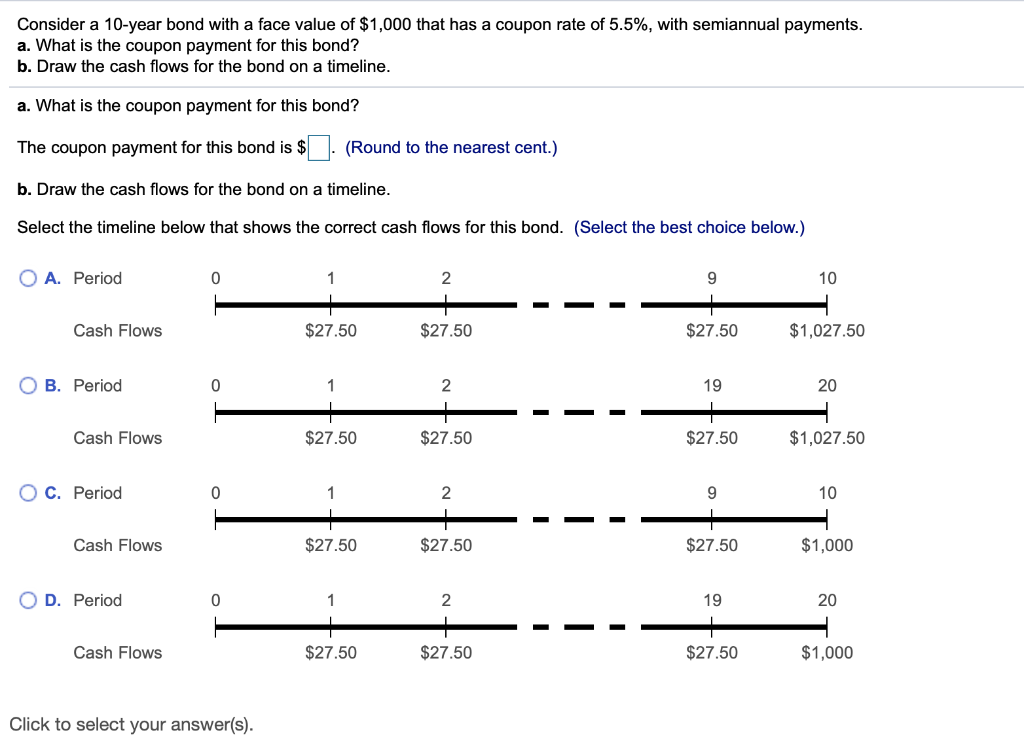

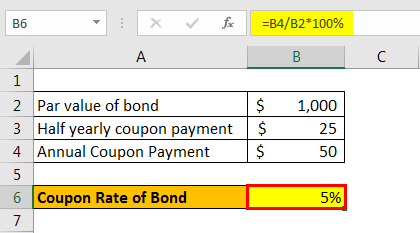

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual ...

Coupon Payment - Investor.gov Coupon Payment The dollar amount of interest paid to an investor. The amount is calculated by multiplying the interest of the bond by its face value.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Updated October 13, 2022 What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What is the coupon payment of a bond with a face value of $5000 ... - Quora Answer (1 of 3): The concept of interest in connection with a bond is at best ambiguous, but more strictly, meaningless. Interest is the charge for the use of borrowed money. You lend a borrower $5000 and they pay you i% interest for the use of it until they pay it back. A bond issuer, however, u...

Bond Definition & Meaning - Merriam-Webster Verkkobond: [verb] to lap (a building material, such as brick) for solidity of construction.

globallegalchronicle.comGlobal Legal Chronicle – Global Legal Chronicle 2 days ago · Goodwin Procter advised FogPharma® on the deal. FogPharma® announced its $178 Million Series D financing. FogPharma is a biopharmaceutical company pioneering a new class of precision...

How To Find Coupon Rate Of A Bond On Financial Calculator For example, you have a $1,000 bond with a $50 coupon payment. To calculate the coupon rate, you would divide $50 by $1,000 and multiply by 100. The result is 5%, which means the bond pays 5% interest per year. Conclusion. After reading this guide, you should know how to calculate a bond's coupon rate on a financial calculator.

What is coupon bond or coupon payment? | Invest Carrier A coupon bond or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from the issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a year divided by the face value of the bond in question).

Coupon Payment Calculator Verkko8.7.2022 · The coupon payment is the interest paid by a bond issuer to a bondholder at each payment period until the bond matures or it is called.The payment schedule can be quarterly, semiannually or annually, depending on the agreed time.. When a bond is first issued, the bond's price is its face value. The bond issuer pays a bondholder a …

en.wikipedia.org › wiki › Zero-coupon_bondZero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

What Is a Coupon Payment? - Smart Capital Mind A coupon payment is a payment made to the holder of a bond for the interest that bond accrues while it is maturing. This is typically made as a semi-annual payment, so only half of the interest owed on the bond is paid at a time.

Coupon Bond - Definition, Terminologies, Why Invest? - WallStreetMojo The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate, which is determined by multiplying the coupon rate by the bond's nominal value and the period factor. For example, if you own a bond with a face value of $1,000 and an annual coupon rate of 5%, your annual interest payment will be $5.

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.

What is a Coupon Payment? - Definition | Meaning | Example Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ...

What is Coupon payment | Capital.com It's the annual interest payment made by the issuer of a bond to the bondholder until it reaches maturity. The coupon payment - or simply coupon is expressed as a percentage of the bond's value at the time it was issued. Where have you heard about coupon payment? The term coupon comes from once popular bearer bond certificates.

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

Coupon (Bonds) - Explained - The Business Professor, LLC A coupon is the amount an investor receives for each acquired bond depending on the percentage initially associated with it. For instance, a bond with a face value of $5000 at 4% interest yield per annum will pay a coupon of $200 yearly and $100 per coupon payment since it is done semi-annually.

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Bond Coupon Payments. A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually on individual bonds. The coupon is always tied to a bond's face or par value and is quoted as a percentage of par. Say you invest $5,000 in a six-year bond paying a coupon rate of five percent per year ...

Bond Coupon Interest Rate: How It Affects Price - Investopedia Verkko18.12.2021 · A bond's current yield, however, is different: a percentage based on the coupon payment divided by the bond's price, it represents the bond's effective return. Coupon Interest Rate vs. Yield .

› Calculate-an-Interest-Payment-onHow to Calculate an Interest Payment on a Bond: 8 Steps - wikiHow Dec 10, 2021 · Coupon. A coupon can be thought of as a bond's interest payment. A bond's coupon is typically expressed as a percentage of the bond's face value. For example, you may see a 5% coupon on a bond with a face value of $1000. In this case, the coupon would be $50 (0.05 multiplied by $1000). It is important to remember the coupon is always an annual ...

Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually.

What is a Coupon Bond? - Definition | Meaning | Example Definition: A coupon bond is a debt instrument that has detachable slips of paper that can be removed from the bond contract itself and brought to a bank or broker for interest payments. These detachable slips of paper are called coupons and represent the interest payments due to the bondholder. Each coupon has its maturity date printed on it.

Coupon (finance) - Wikipedia VerkkoIn finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 …

How to Calculate a Coupon Payment: 7 Steps (with Pictures) Verkko2.8.2020 · Use the current yield to calculate the annual coupon payment. This only works if your broker provided you with the current yield of the bond. To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value).

Zero-coupon bond - Wikipedia VerkkoA zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of …

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note

What Is a Bond Coupon, and How Is It Calculated? - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

What is coupon on bonds? - moneycontrol.com Coupon rate is calculated by taking the annual coupon payment and dividing it by the bond's face value. For instance, if you have a 10-year bonds worth Rs 5,000 having a coupon rate of 10%, then ...

What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

Post a Comment for "41 what is a coupon payment on a bond"