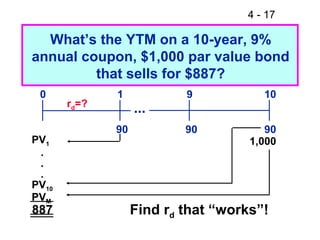

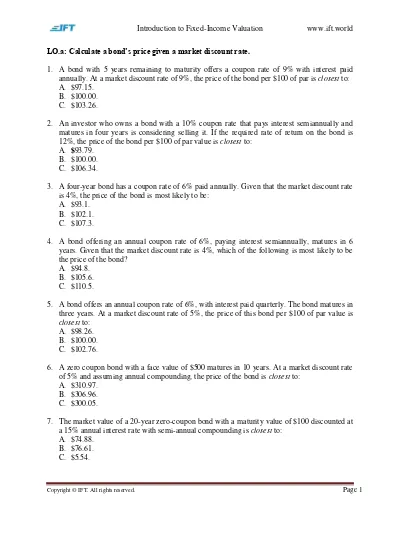

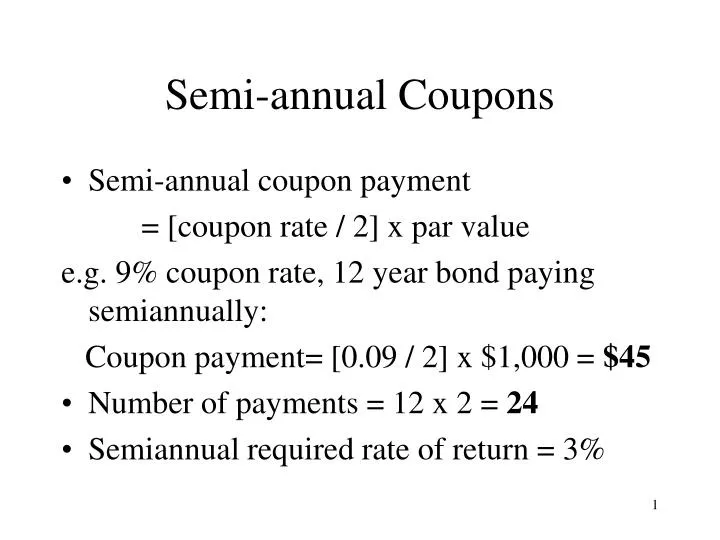

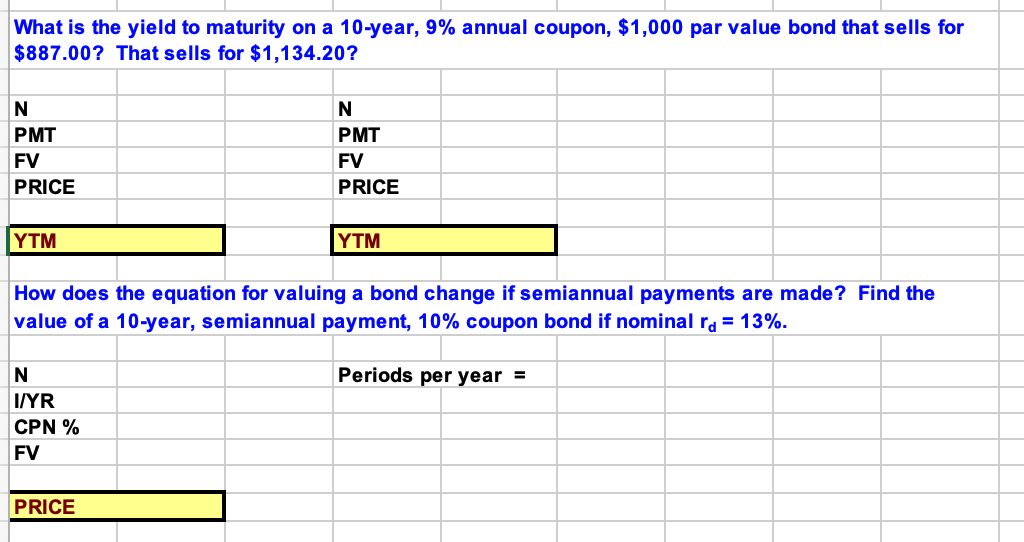

43 a 10 year bond with a 9 annual coupon

iShares 10+ Year Investment Grade Corporate Bond ETF | IGLB The iShares 10+ Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S. dollar-denominated investment-grade corporate bonds with remaining maturities greater than ten years. 10 Year Treasury Rate - 54 Year Historical Chart | MacroTrends 10 Year Treasury Rate - 54 Year Historical Chart. Interactive chart showing the daily 10 year treasury yield back to 1962. The 10 year treasury is the benchmark used to decide mortgage rates across the U.S. and is the most liquid and widely traded bond in the world. The current 10 year treasury yield as of October 26, 2022 is 4.04%.

Music News - Rolling Stone Nearly a year after announcing plans to disband, the group's last LP arrives Nov. 17 The Show Is Over By Daniel Kreps. 5 hours ago ... Oct 27, 2022 9:51 am Read More Trending

A 10 year bond with a 9 annual coupon

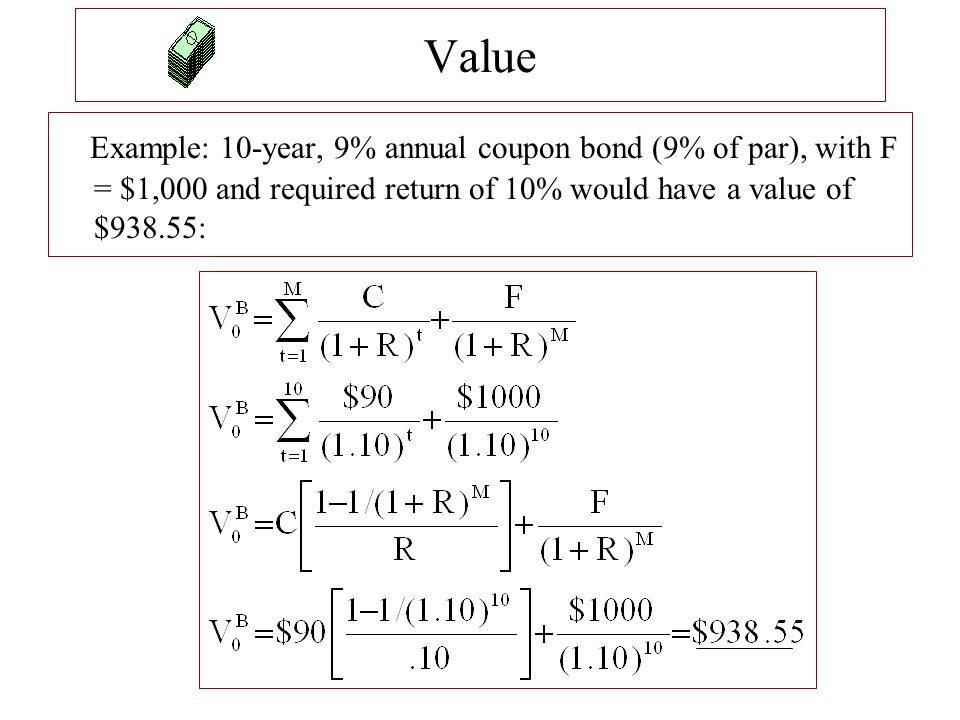

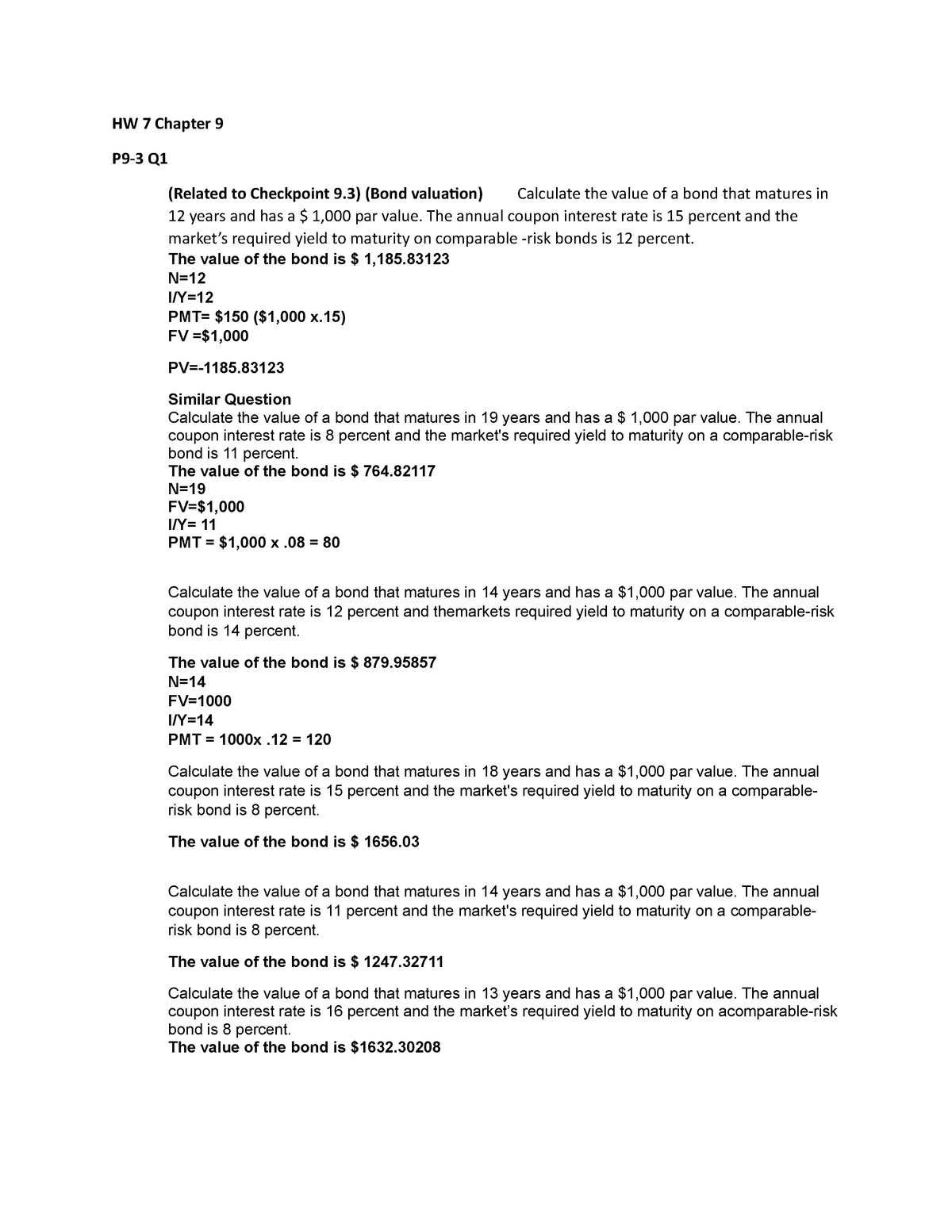

Government bond - Wikipedia For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% of the $20,000 each year. At the maturity date the government would give back the original $20,000. Sanctions Programs and Country Information | U.S. Department ... Oct 26, 2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 Balkans-Related Sanctions 10/03/2022 Belarus ... Interest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ...

A 10 year bond with a 9 annual coupon. Publication 519 (2021), U.S. Tax Guide for Aliens | Internal ... Interest paid by a resident alien or a domestic corporation on obligations issued before August 10, 2010, if for the 3-year period ending with the close of the payer's tax year preceding the interest payment, at least 80% (0.80) of the payer's total gross income: Interest Rate Statistics | U.S. Department of the Treasury Treasury ceased publication of the 30-year constant maturity series on February 18, 2002 and resumed that series on February 9, 2006. To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate ... Sanctions Programs and Country Information | U.S. Department ... Oct 26, 2022 · OFAC administers a number of different sanctions programs. The sanctions can be either comprehensive or selective, using the blocking of assets and trade restrictions to accomplish foreign policy and national security goals. Where is OFAC's country list? Active Sanctions Programs: Program Last Updated: Afghanistan-Related Sanctions 02/25/2022 Balkans-Related Sanctions 10/03/2022 Belarus ... Government bond - Wikipedia For example, a bondholder invests $20,000 (called face value) into a 10-year government bond with a 10% annual coupon; the government would pay the bondholder 10% of the $20,000 each year. At the maturity date the government would give back the original $20,000.

Post a Comment for "43 a 10 year bond with a 9 annual coupon"