41 relationship between coupon rate and ytm

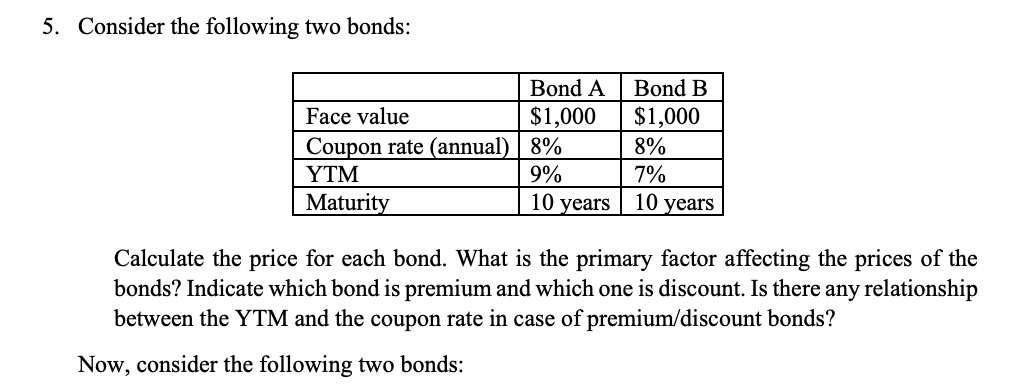

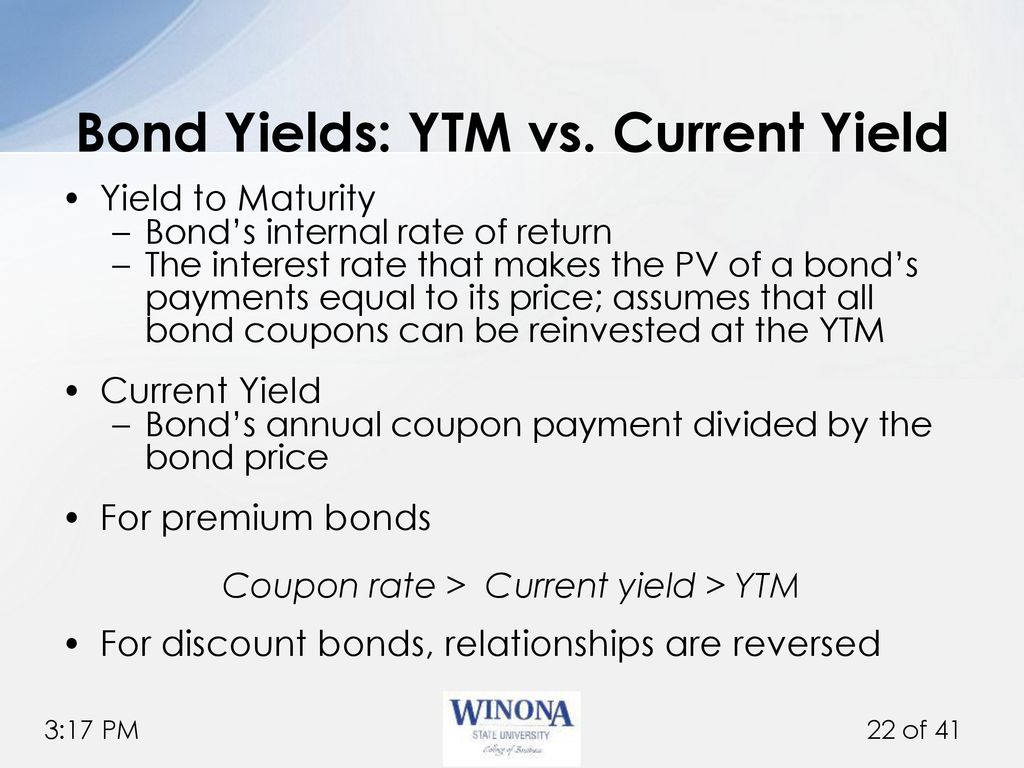

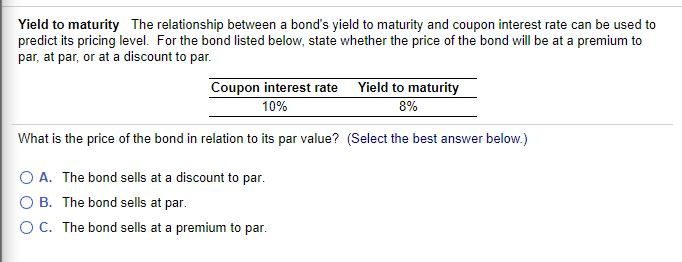

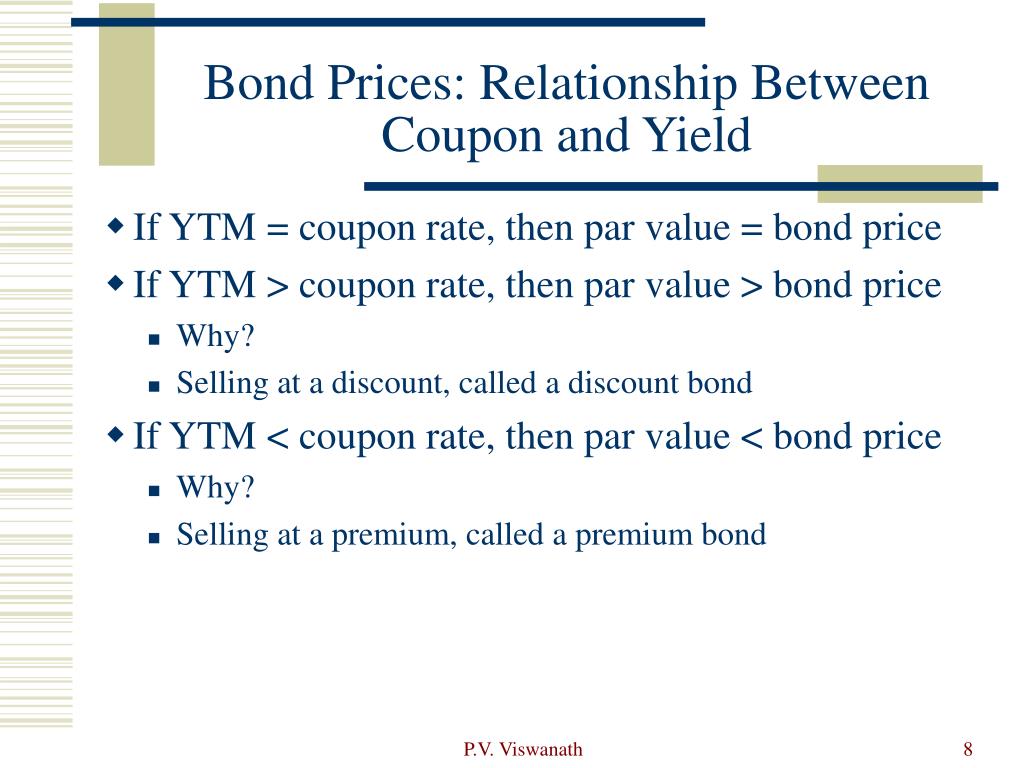

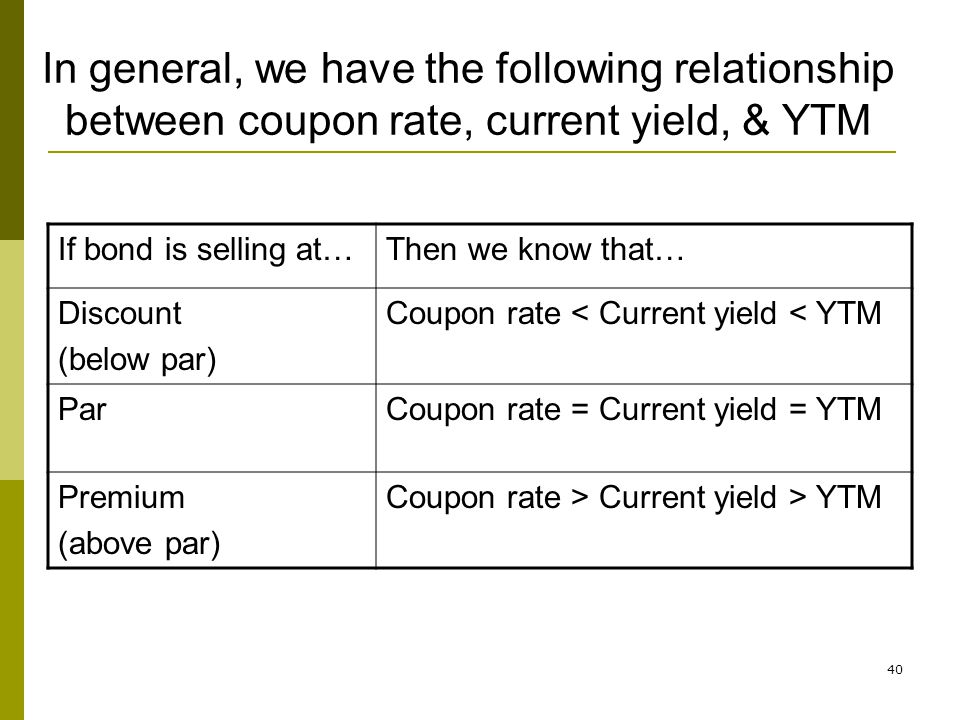

Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Learn How Coupon Rate Affects Bond Pricing The yield-to-maturity only equals the coupon rate when the bond sells at face value. The bond sells at a discount if its market price is below the par value. In ...

Course Help Online - Have your academic paper written by a ... 100% money-back guarantee. With our money back guarantee, our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Relationship between coupon rate and ytm

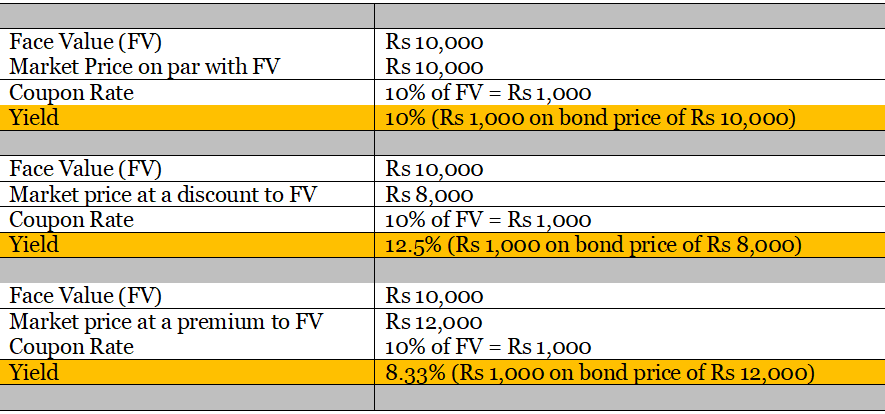

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... 4 Basic Things to Know About Bonds - Investopedia Aug 26, 2021 · The coupon is also called the coupon rate or nominal yield. To calculate the coupon rate, divide the annual payments by the face value of the bond. To calculate the coupon rate, divide the annual ... Zero-Coupon Bonds: Characteristics and Examples Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price.

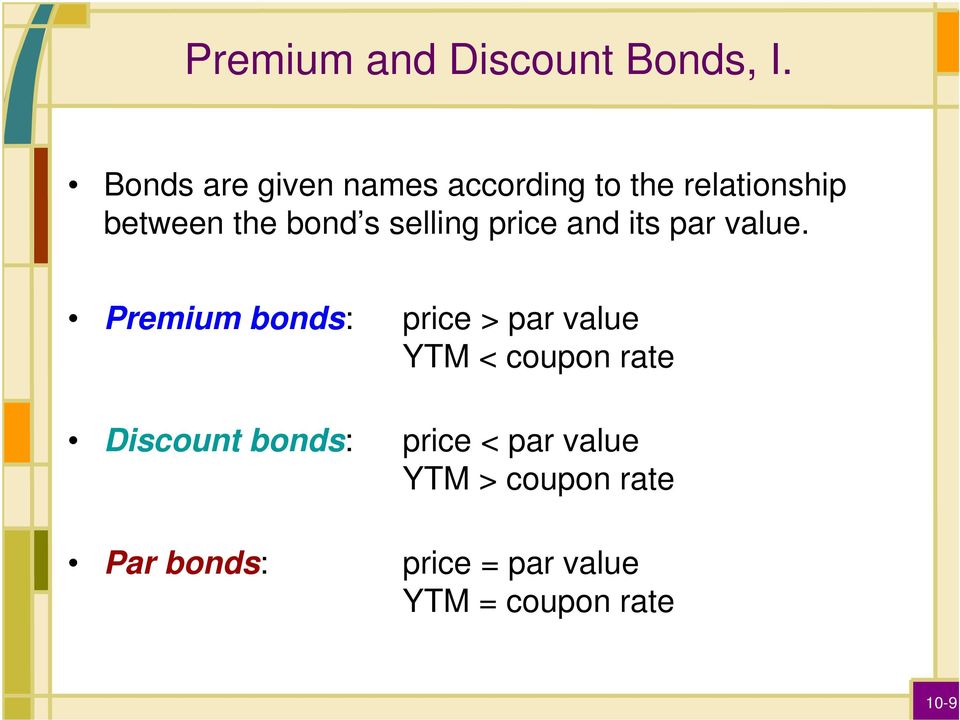

Relationship between coupon rate and ytm. What relationship between a bond's coupon rate and ... - Quora If the bond yield is less than the bond's coupon rate, then the bond will trade at a premium. Likewise, if the bond yield is more than the bond's coupon rate, ... Difference Between YTM and Coupon rates 1. YTM is the rate of return estimated on a bond if it is held until the maturity date, while the coupon rate is the amount of interest paid per ... Relationships among a Bond's Price, Coupon Rate, Maturity ... A bond's price moves inversely with its YTM. An increase in YTM decreases the price and a decrease in YTM increases the price of a bond. · The relationship ... Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

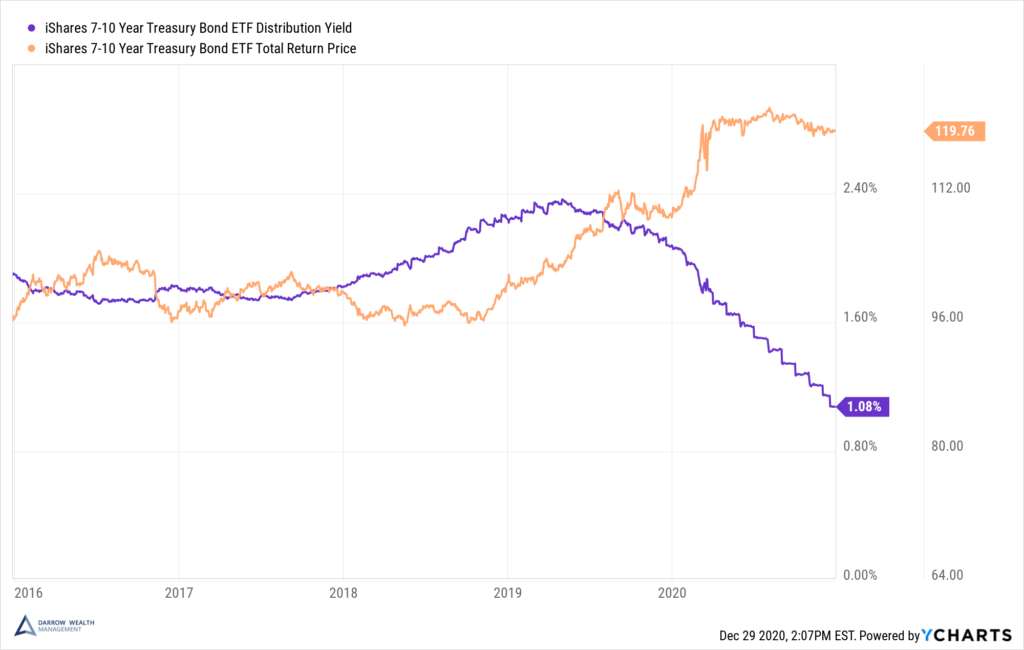

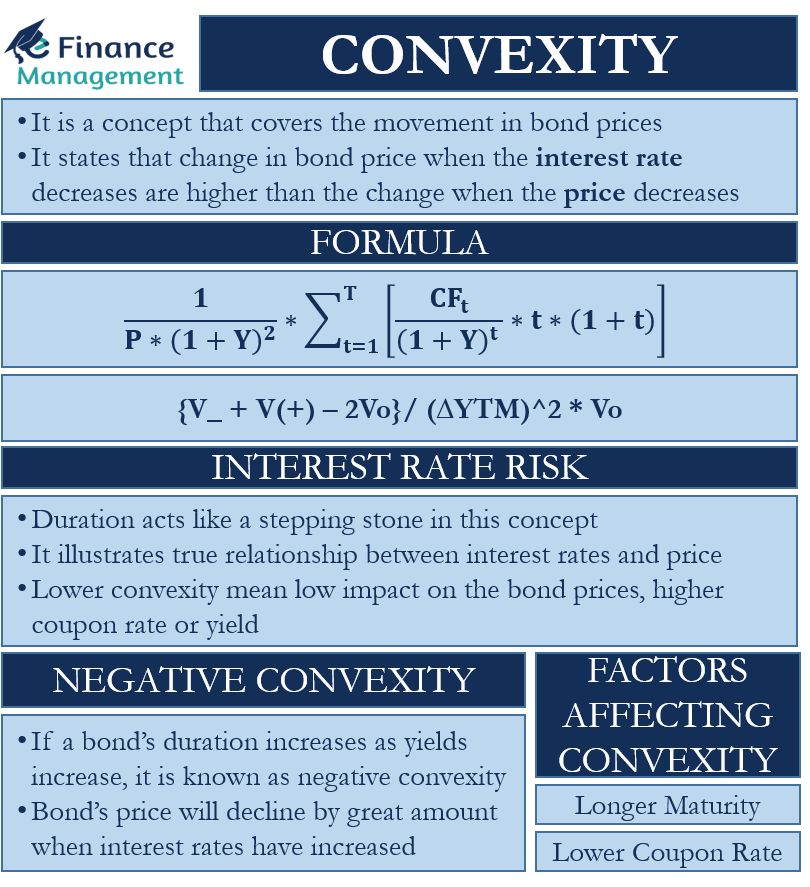

Difference between Coupon Rate And Yield To Maturity Another difference between these two metrics is that the YTM represents the average rate of return that an investor is likely to experience over the bond's ... Assignment Essays - Best Custom Writing Services Get 24⁄7 customer support help when you place a homework help service order with us. We will guide you on how to place your essay help, proofreading and editing your draft – fixing the grammar, spelling, or formatting of your paper easily and cheaply. What is the relationship between the coupon rate and the YTM ... The coupon rate is applied to calculate the coupon payments by multiplying the coupon rate by the par value. The yield to maturity serves as the internal rate ... Duration vs. Maturity and Why the Difference Matters Sep 01, 2017 · See the diagram below to understand the relationship between the bond’s price and its interest rate (or coupon rate). A bond is quoted with its “coupon yield”. This refers to the annual interest payable as a percent of the original face or par value. An 8% bond with a par value of 1000 would receive $80 per year. Coupon/Interest Rate= 8% ...

Zero-Coupon Bonds: Characteristics and Examples Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. 4 Basic Things to Know About Bonds - Investopedia Aug 26, 2021 · The coupon is also called the coupon rate or nominal yield. To calculate the coupon rate, divide the annual payments by the face value of the bond. To calculate the coupon rate, divide the annual ... When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "41 relationship between coupon rate and ytm"