42 payment coupon for irs

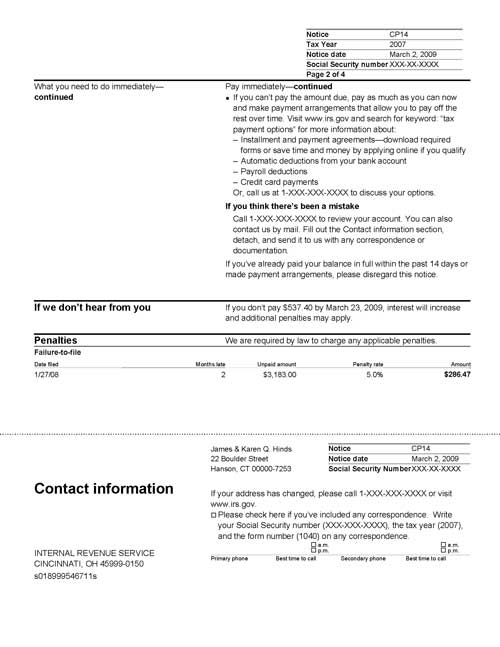

2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms - Illinois 2022 IL-501 Payment Coupon - Withholding (Payroll) Tax Forms, Revenue, Forms, Withholding (Payroll) Tax Forms, 2022 IL-501 Payment Coupon, Did you know you can make this payment online? Paying online is quick and easy! Click here to pay your IL-501 online, Click here to download the PDF payment coupon, Form 1040-V: Payment Voucher Definition - Investopedia Jan 29, 2022 · Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. The ...

IRS payment options | Internal Revenue Service For more information, go to Pay by Check or Money Order on IRS.gov. 2020 Estimated Tax Payments - Taxpayers making their 2020 estimated tax payment by check, money order or cashier's check should include the appropriate Form 1040-ES payment voucher. Indicate on the check memo line that this is a 2020 estimated tax payment. Paying by cash ...

Payment coupon for irs

Payments | Internal Revenue Service - IRS tax forms View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account, Pay from Your Bank Account, For individuals only. No registration required. No fees from IRS. About Form 1041-V, Payment Voucher - IRS tax forms About Form 1041-V, Payment Voucher, Submit this voucher with your check or money order for any balance due on an estate's or trust's Form 1041. Current Revision, Form 1041-V PDF, Recent Developments, None at this time. Other Items You May Find Useful, All Form 1041-V Revisions, About Publication 559, Survivors, Executors, and Administrators, Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax)

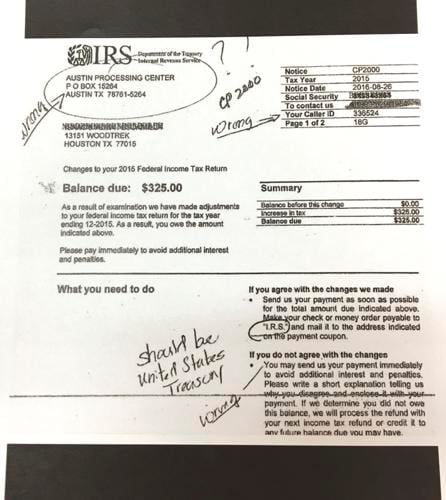

Payment coupon for irs. Confirm the IRS Received Your Payment | H&R Block If two weeks have gone by since you sent the last payment and your bank verifies that the check hasn’t cleared your account, call the IRS at 800-829-1040. Ask them if the payment has been credited to your account. If the IRS cash check processing your tax payment hasn’t been completed and your check hasn’t yet cleared, you can: Printable 2021 Federal Form 1040-V (Payment Voucher) - Tax-Brackets.org More about the Federal Form 1040-V Voucher. We last updated Federal Form 1040-V in January 2022 from the Federal Internal Revenue Service. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government. PDF 2022 Form 760ES, Estimated Income Tax Payment Vouchers ... - Virginia Tax seaman are met, you only need to file Payment Voucher 4 by January 15, 2023. If you file your 2022 income tax return on or before March 1, 2023, and pay the entire tax at that time, you are not required to file Form 760ES for 2022. III. HOW TO ESTIMATE You must pay least 90% of your tax liability during the year by Four Things You Should Know Before Calling the IRS You want to know the status of any IRS action (like a penalty abatement request, a payment correction, etc.) You want to make sure the IRS received your payment. You lost or never received your Form W-2 and/or Form 1099-R – or you got an incorrect one.

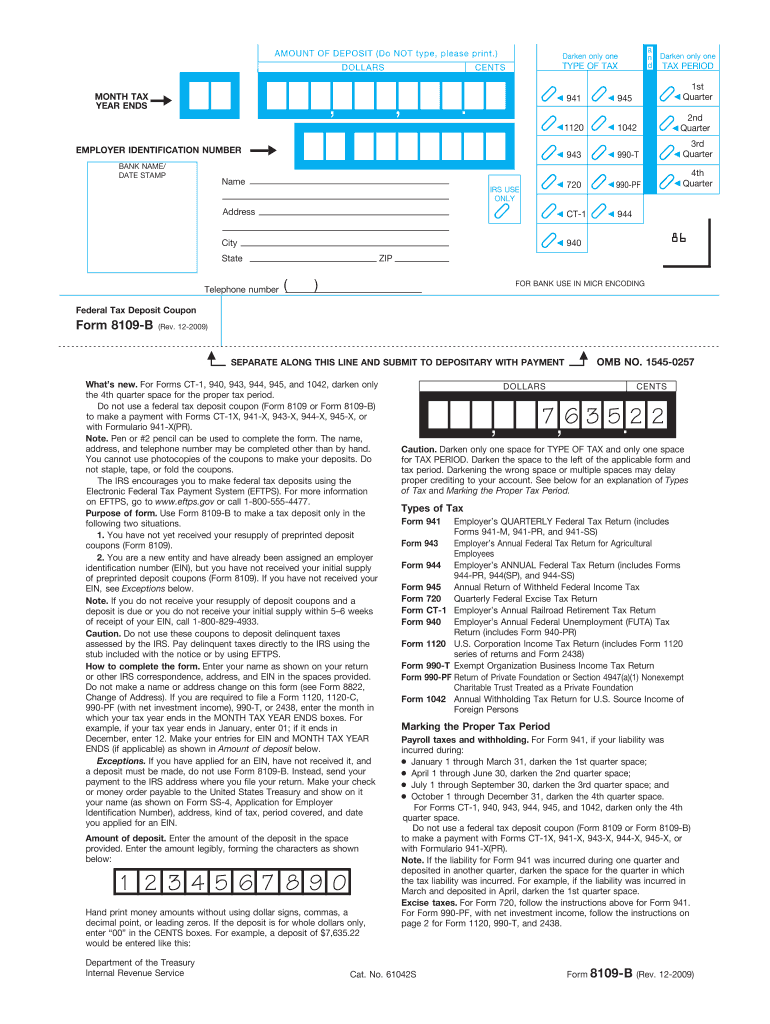

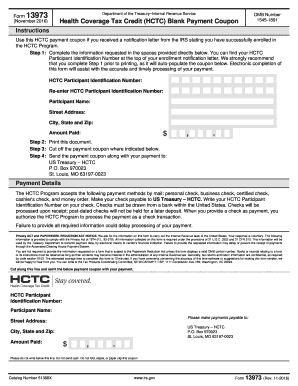

Form 941-V, Payment Voucher - REGINFO.GOV Payment Voucher. . Don't staple this voucher or your payment to Form 941. OMB No. 1545-0029. 2017. 1. Enter your employer identification number (EIN). 2. Enter the amount of your payment. . Make your check or money order payable to "United States Treasury" Dollars. Cents3. Tax Period. 1st Quarter 2nd Quarter. 3rd Quarter 4th Quarter. 4 Form IT-2105, Estimated Tax Payment Voucher for Individuals Pay by credit card (2.25% convenience fee) Simply log in to your Online Services account, select the ≡ Services menu from the upper left-hand corner of the page, choose Payments, bills and notices, then select Make a payment from the expanded menu. (You'll need to create an account if you don't already have one.) PDF 2022 Form 1040-ES - IRS tax forms Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding, you should make estimated tax payments on other What is a Coupon Payment? - Definition | Meaning | Example What is the definition of coupon payment? Coupon payments are vital incentives to investors who are attracted to lower risk investments. These payments get their name from previous generations of bonds that had a physical, tear off coupon that investors had to physically hand in to the issuer as evidence that they owned the bond.

CA Form DE 88 - Payment Coupon - CFS Tax Software, Inc. CA Form DE 88 - Payment Coupon, Tax returns, wage reports, and payroll tax deposit coupons are no longer available without an approved e-file and e-pay mandate waiver. You must submit these forms electronically. If you have an approved waiver, you will automatically receive payment coupons and tax forms in the mail. IRS Mailing Address: Where to Mail IRS Payments File Part 2: Mailing Address for Estimated Tax Payment (Form 1040-ES) For people who are required to make an estimated tax payment, Form 1040-ES, which is the estimated tax voucher can be used to submit your payment to the IRS using the following addresses. Tip: The mailing address of Form 1040-ES can be slightly different every year. Payment Coupon Templates - 11+ Free Printable PDF Documents Download Payment Coupon Templates - 11+ Free Printable PDF Documents Download, A payment coupon template was designed to help you help customers make payments at the counter in a personalized way. The coupon template is only used at an instance where you want your customers to purchase available items at discount prices. PDF 2021 Payment Coupon (IL-501) and Instructions - Illinois mail Form IL-501 if you electronically pay or are reporting a zero amount. Illinois Department of Revenue. Payment Coupon. IL-501. more information. Do not . make a payment or submit an IL-501 Payment Coupon if no Illinois income tax was withheld. When is income tax considered withheld? In Illinois, income tax is considered withheld

About Form 1040-V, Payment Voucher - IRS tax forms About Form 1040-V, Payment Voucher, Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision, Form 1040-V PDF, Recent Developments, None at this time. Other Items You May Find Useful, All Form 1040-V Revisions, Paying Your Taxes,

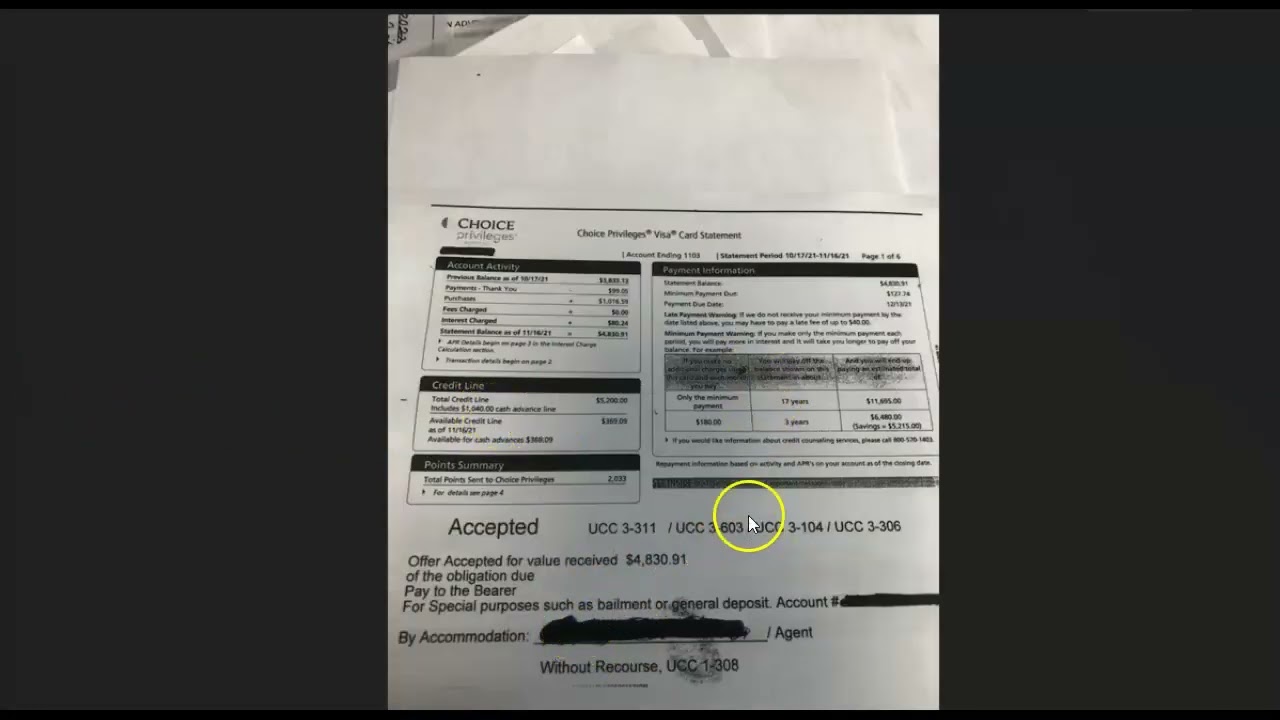

How To Pay Bills with Coupon | LEGALIBUS We are going to study how to use coupons to pay bills. Join Course More info. Responsible: Administrator: Last Update: 08/05/2022: Completion Time: 31 minutes: Members: 3394: Share Course Reviews (24) Forum; Intermediate Christopher Hauser Access Trust Fund. Introduction. Definitions. Requirements. First Attempt ...

3 Ways to Set Up a Payment Plan with the IRS - wikiHow Businesses are eligible for long-term payment plans if they owe less than $25,000. If you owe more than $50,000 but less than $100,000, you are only eligible for a short-term payment plan. Generally, you must pay the full amount you owe to the IRS in less than 120 days. 2, Gather the information you'll need to apply online.

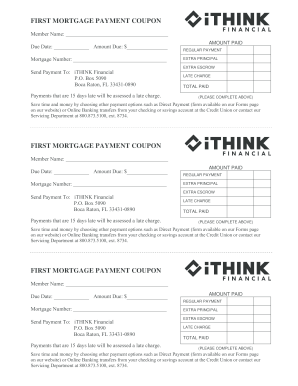

Payment Coupon Books, Payment Books - Bank-A-Count.com Payment coupon books are the easy way to collect payment from your customers. Books have a variety of features and can be customized to suit your individual needs. Choose from custom inserts, coupon formats, and more! All Bank-A-Count products are backed by an outstanding customer service team. Payment books feature: Affordable, competitive pricing

7 Ways To Send Payments to the IRS - The Balance You can typically take an extension by filing Form 4868 with the IRS (instead of a tax return) by the tax filing deadline, giving you until October 18, 2022, to submit your return. But any payment you owe is still due by the original tax due date, which is April 18 in 2022 for 2021 tax returns. 3 You should submit your tax payment along with ...

Make a Payment | Minnesota Department of Revenue If you received a bill from the Minnesota Department of Revenue and cannot pay in full, you may request an installment plan. For more information, see Payment Agreements. Bank Account [+] ACH Credit [+] Check or Money Order [+] Credit or Debit Card [+] Cash [+] Bank Wire [+] Contact Info, Email, Contact form, Phone, 651-556-3000, 800-657-3666,

What do I do with the Payment Voucher? - Intuit New Member. June 5, 2019 3:46 PM. Form 1040-V: Payment Voucher (not to be confused with 1040-ES: Estimated Tax Voucher) is an optional IRS form that you include with your check or money order when you mail your tax payment. Although the IRS will gladly accept your payment without the 1040-V, including it enables the IRS to process your payment ...

Documentation: Tax Invoice; Bill of Supply; Receipt Voucher; Payment ... Tax Invoice Section 31 of the CGST Act has made it mandatory for every registered supplier to issue a tax invoice for every supply of goods or services. If the supplier is unregistered, the buyer needs to issue a payment voucher and a tax invoice. A tax invoice should ideally contain the below details: Supplier…

PDF 2021 Form 770-PMT, Payment Coupon - Virginia Tax For additional information visit or call (804) 367-8031. VIRGINIA DEPARTMENT OF TAXATION FORM 770-PMT - 2021 PAYMENT COUPON Va. Dept. of Taxation 770PMT 2601052 Rev. 06/21 Tax.00 Penalty.00 Interest.00 Amount of Payment.00 Payment Type 770 Return Payment 765 Return Payment Name of Estate, Trust or Pass-Through Entity

2021 Form 1040-V - IRS tax forms , to see all your electronic payment options. How To Fill In Form 1040-V, Line 1. Enter your social security number (SSN). If you are filing a joint return, enter the SSN shown first on your return. Line 2. If you are filing a joint return, enter the SSN shown second on your return. Line 3.

2022 Federal Estimated Tax Vouchers Printable Coupon FREE From irs.gov, IR-2022-77, April 6, 2022 — The IRS today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others … ... No need code, Get Code, 2022 FEDERAL ESTIMATED TAX VOUCHERS PRINTABLE COUPON, 11 hours ago, FREE From fishfinderdiscounts.com,

For those who make estimated federal tax payments, the first quarter ... IR-2022-77, April 6, 2022, WASHINGTON — The Internal Revenue Service today reminds those who make estimated tax payments such as self-employed individuals, retirees, investors, businesses, corporations and others that the payment for the first quarter of 2022 is due Monday, April 18.

State of Oregon: Oregon Department of Revenue - Payments Electronic payment from your checking or savings account through the Oregon Tax Payment System. ... Mail check or money order with voucher to: Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050; Cash payments must be made at our Salem headquarters located at:

Estimated tax payments | FTB.ca.gov - California Generally, you must make estimated tax payments if in 2022 you expect to owe at least: $500. $250 if married/RDP filing separately. And, you expect your withholding and credits to be less than the smaller of one of the following: 90% of the current year's tax. 100% of the prior year's tax (including alternative minimum tax)

About Form 1041-V, Payment Voucher - IRS tax forms About Form 1041-V, Payment Voucher, Submit this voucher with your check or money order for any balance due on an estate's or trust's Form 1041. Current Revision, Form 1041-V PDF, Recent Developments, None at this time. Other Items You May Find Useful, All Form 1041-V Revisions, About Publication 559, Survivors, Executors, and Administrators,

Payments | Internal Revenue Service - IRS tax forms View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account, Pay from Your Bank Account, For individuals only. No registration required. No fees from IRS.

/1040-V-df038816cc244b248641f447493a030d.jpg)

Post a Comment for "42 payment coupon for irs"