38 present value of coupon bond

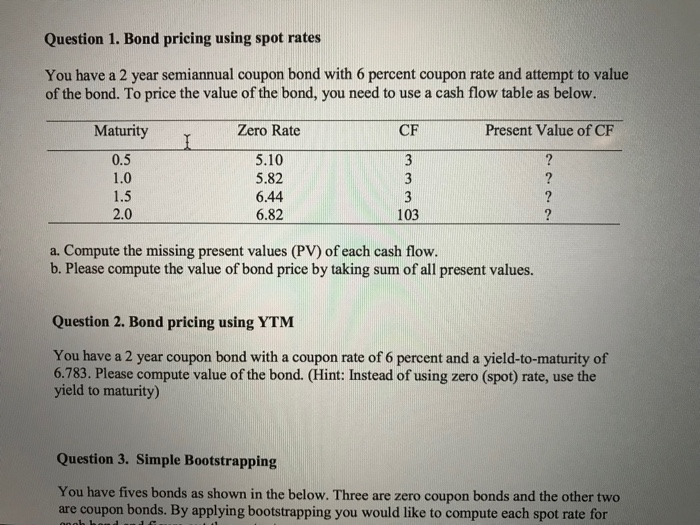

Bond Valuation using Yield to Maturity & Spot Interest Rates - XPLAIND.com If the bond has 1.5 years left till maturity, let us value it based on the spot rates applicable to each cash flow. Let us imagine the yield on zero coupon bonds of comparable risk with maturity of 6 months, 1 years and 1.5 years is 4%, 4.1% and 4.5%. Since the bond pays semi-annual coupons, we need to include semi-annual spot interest rates. Present Value Calculator - Moneychimp Present Value Formula. Present value is compound interest in reverse: finding the amount you would need to invest today in order to have a specified balance in the future. Among other places, it's used in the theory of stock valuation. See How Finance Works for the present value formula. You can also sometimes estimate present value with The ...

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Present value of coupon bond

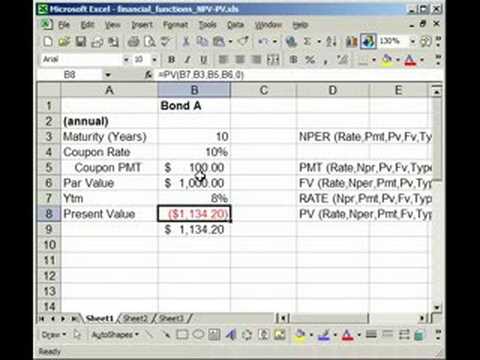

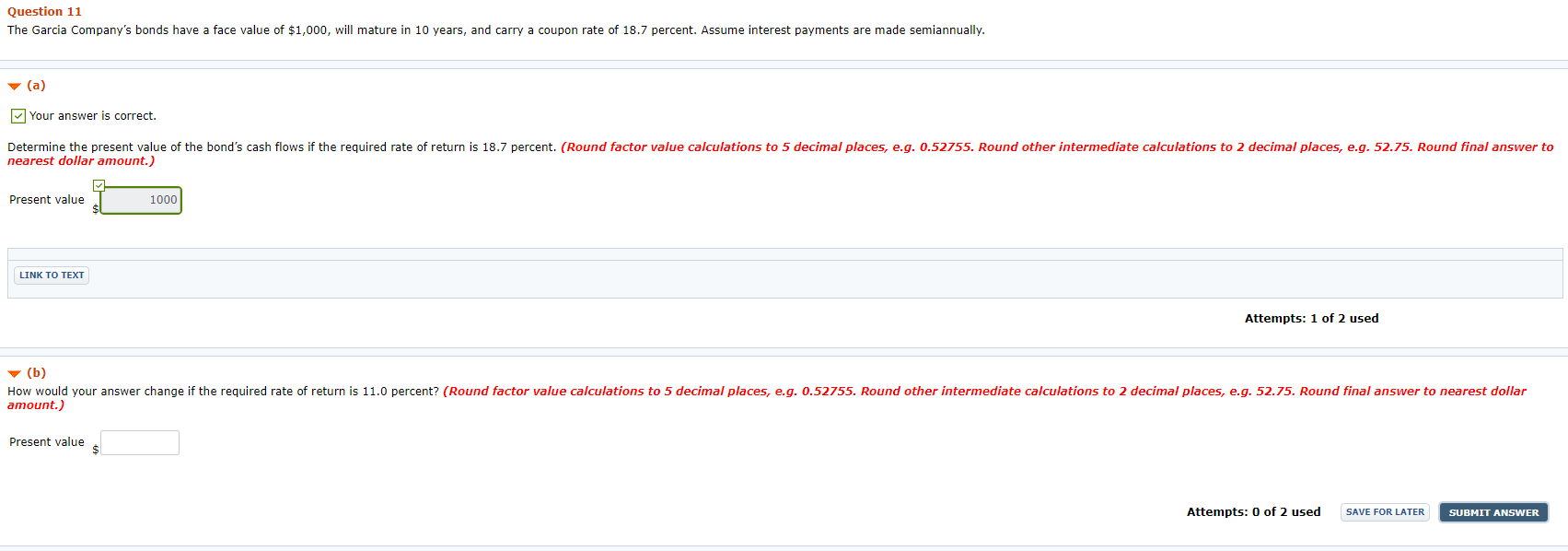

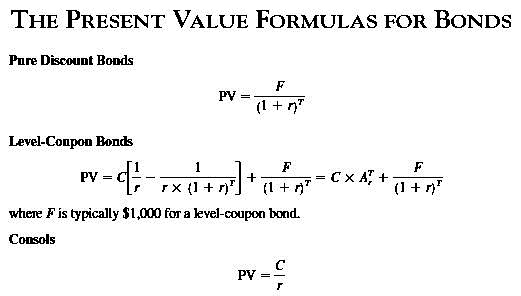

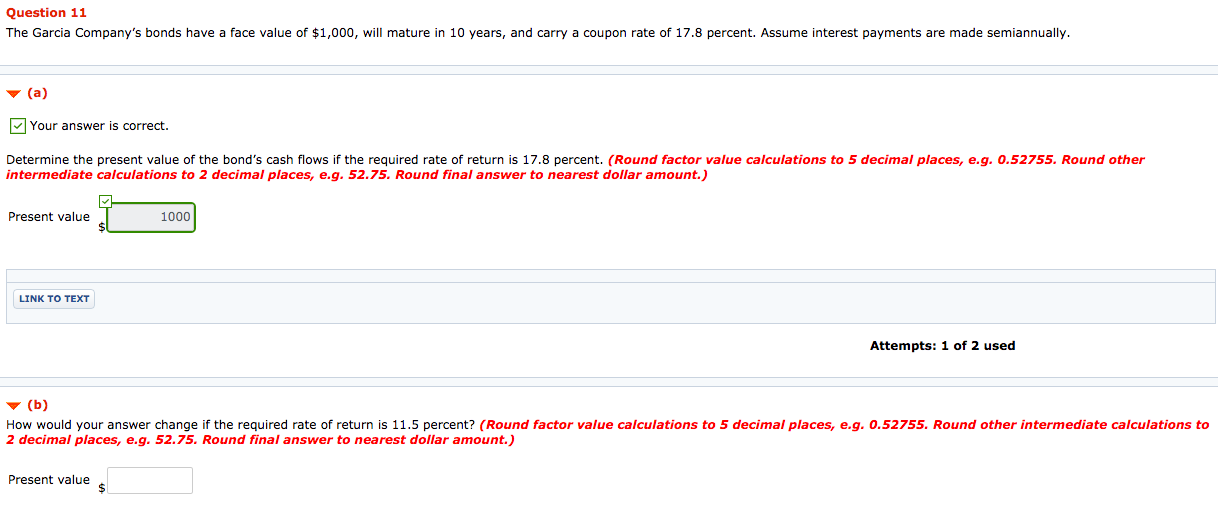

Valuing Bonds | Boundless Finance | | Course Hero The formula for calculating a bond's price uses the basic present value (PV) formula for a given discount rate. Bond Price: Bond price is the present value of coupon payments and face value paid at maturity. Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Calculating the Present Value of a 9% Bond in a 10% Market The present value of a bond's maturity amount. The present value of the 9% 5-year bond that is sold in a 10% market is $96,149 consisting of: $34,749 of present value for the interest payments, PLUS. $61,400 of present value for the maturity amount. The bond's total present value of $96,149 is approximately the bond's market value and issue price.

Present value of coupon bond. How to calculate the present value of a bond — AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Excel formula: Bond valuation example | Exceljet The arguments provided to PV are as follows: rate - C6/C8 = 8%/2 = 4% nper - C7*C8 = 3*2 = 6 pmt - C5/C8*C4 = 7%/2*1000 = 35 fv - 1000 The PV function returns -973.79. To get positive dollars, we use a negative sign before the PV function to get final result of $973.79 Between coupon payment dates How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Zero-Coupon Bond: Formula and Calculator [Excel Template] Present Value (PV) = $1,000 / (1 + 3.0% / 2) ^ (10 * 2) PV = $742.47 The price of this zero-coupon is $742.47, which is the estimated maximum amount that you can pay for the bond and still meet your required rate of return. Zero-Coupon Bond Yield Example Calculation

Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27 The Present Value of the Par Value ( time value of money ) =$680.58 The Present Value of a Bond = $ 399.27 + $ 680.58 = $1,079.86 How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%. The investor pays 816 today and receives the face value of the bond (1,000) at the maturity date, as shown in the cash flow diagram below. Zero Coupon Bond Rates Coupon Rate Calculator | Bond Coupon And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate. The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value. For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find ... Bond Valuation: Calculation, Definition, Formula, and Example Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

How to Calculate Present Value of a Bond - Pediaa.Com A bond is a financial debt instrument. Calculating present value of a bond involves discounting coupon income based on the market interest rate plus discounting the face value of the bond after the maturity period. This value represents the current value of the future cash flows that will be generated by this instrument. Save Coupon Rate of a Bond - WallStreetMojo Par value of bond = $1,000 Annual interest payment = 4 * Quarterly interest payment = 4 * $15 = $60 Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount . Corporate Bond Valuation - Overview, How To Value And Calculate Yield A common way to visualize the valuation of corporate bonds is through a probability tree. Consider the following example of a corporate bond: 3-year maturity $1,000 face value 5% coupon rate ($50 coupon payments paid annually) 60 payout ratio ($600 default payout) 10 probability of default 5% risk-adjusted discount rate Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is. Price = M / (1+r)n. where: M = maturity value or face value of the bond. r = rate of interest required. n = number of years to maturity. 3.

Econ Chapter 4 Flashcards | Quizlet The present value of a bond that matures in 21 months is $2,500. At 4% interest rate, compounded annually, the future value of the bond is equal to _____. A. $5,359 ... The value of a coupon bond falls as the value of its yearly coupon payments falls. Which of the following does not explain why this is so?

Bond Valuation: Formula, Steps & Examples - Study.com The value of a bond is the present value sum of its discounted cash flows. Bonds have a face value, a coupon rate, a maturity date, and a discount rate. ... For example, find the present value of ...

How to Figure Out the Present Value of a Bond - dummies Use the present value factors to calculate the present value of each amount in dollars. The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond.

What Is Present Value (PV)? - Investopedia Jun 13, 2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Present Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ...

Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42 A natural question one would ask is, what does this tell me?

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA Coupon bond = $40* [ (1- (1+7%/2))^ (-12)) / (7%/2) ] + [$1,000/ (1+7%/2)^12] Coupon Bond = $951.68 Therefore, the price of the CB raised by ZXC Inc. will be $951.68. Coupon Bond Price The price of a CB (or any other bond)represents its market value or how much the investors are willing to pay in the open market.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond = $1,033 Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation The formula for coupon bond can be derived by using the following steps:

Present Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash flow.

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

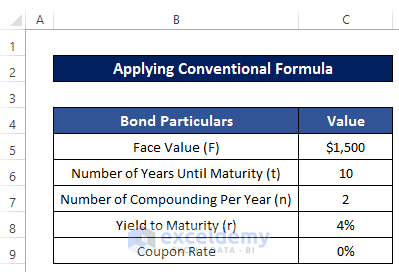

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity.

Net present value - Wikipedia Observe that as t increases the present value of each cash flow at t decreases. For example, the final incoming cash flow has a future value of 10,000 at t = 12 but has a present value (at t = 0 t = 0 (the present value) at an interest rate of 10% compounded for 12 years, which results in a cash flow of 10,000 at t = 12 (the future value). The ...

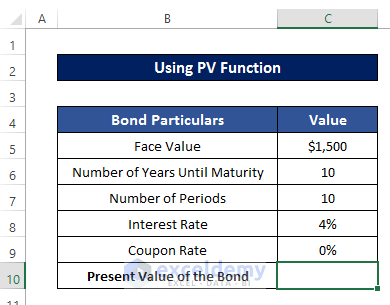

How to Calculate Bond Price in Excel (4 Simple Ways) Users can calculate the bond price using the Present Value Method ( PV ). In the method, users find the present value of all the future probable cash flows. Present Value calculation includes Coupon Payments and face value amount at maturity. The typical Coupon Bond Price formula is 🔄 Coupon Bond Price Calculation

Calculating the Present Value of a 9% Bond in a 10% Market The present value of a bond's maturity amount. The present value of the 9% 5-year bond that is sold in a 10% market is $96,149 consisting of: $34,749 of present value for the interest payments, PLUS. $61,400 of present value for the maturity amount. The bond's total present value of $96,149 is approximately the bond's market value and issue price.

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

Valuing Bonds | Boundless Finance | | Course Hero The formula for calculating a bond's price uses the basic present value (PV) formula for a given discount rate. Bond Price: Bond price is the present value of coupon payments and face value paid at maturity.

Post a Comment for "38 present value of coupon bond"