40 how to find the coupon rate of a bond

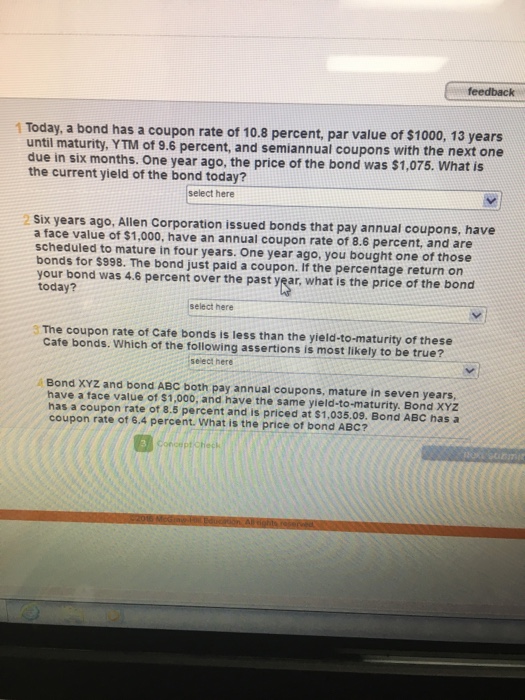

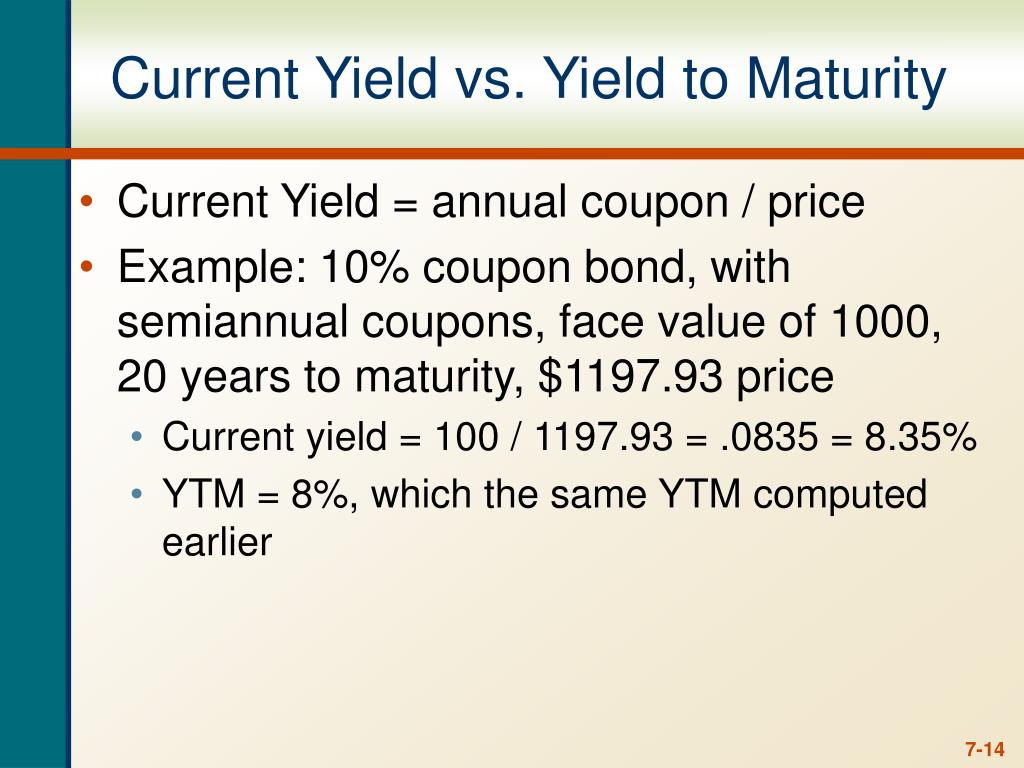

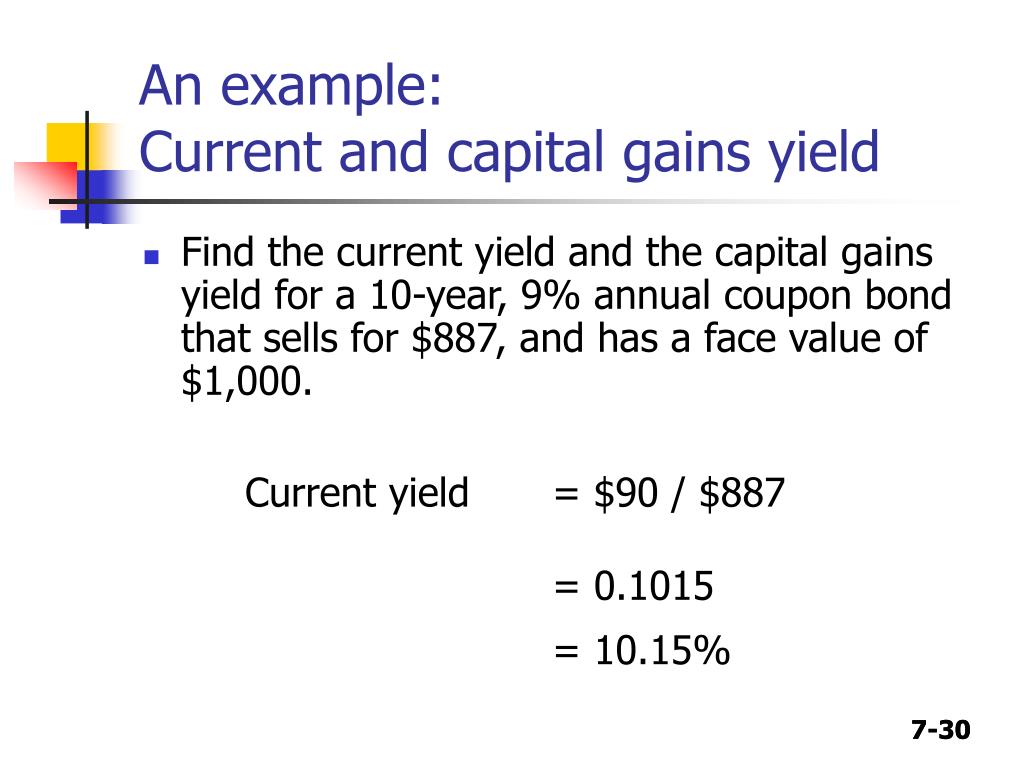

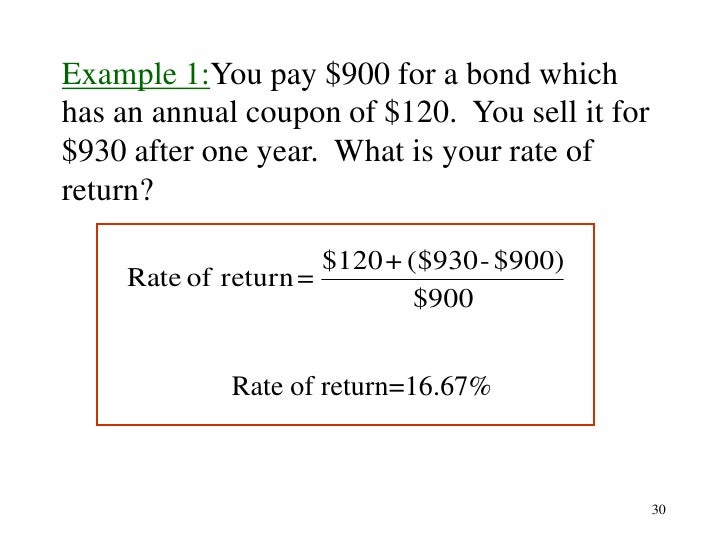

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon Rate Definition The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity ...

Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Rate ...

How to find the coupon rate of a bond

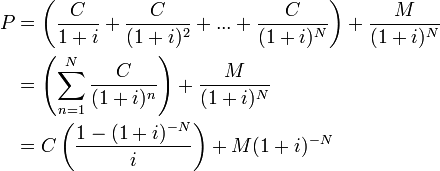

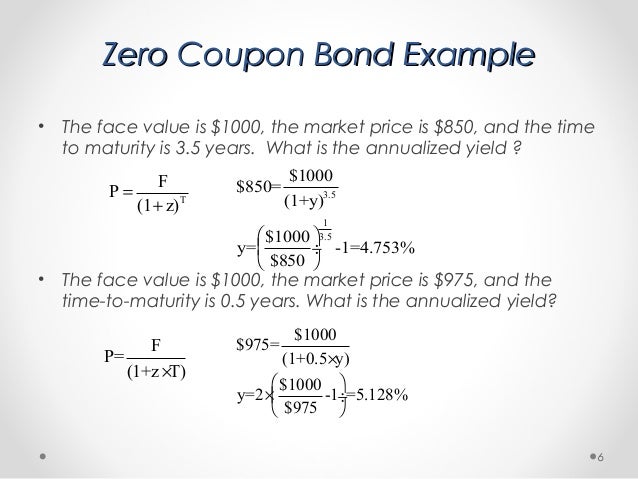

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price. sjbek.ndc24.pl rate. t = Number of years. n = Number of compounding periods of a discount rate per year. Estimating the zero coupon rate or zero rates using the bootstrap approach and with excel Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

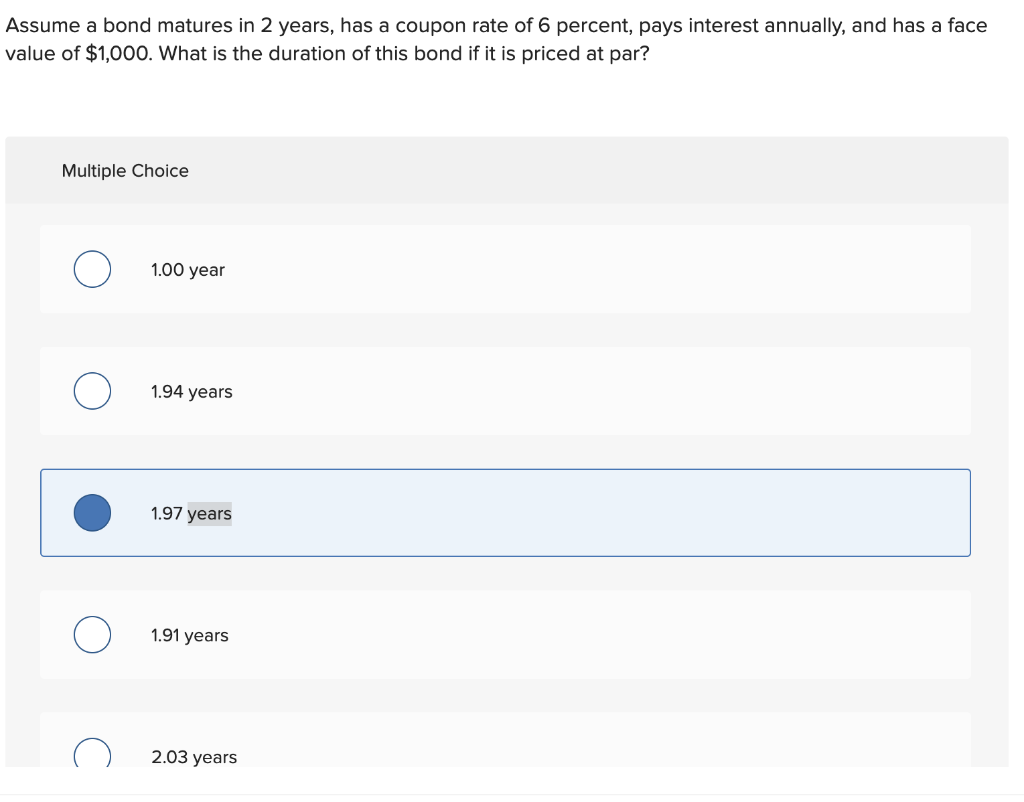

How to find the coupon rate of a bond. Coupon Bond Formula | Examples with Excel Template The bonds offer coupon rate of 5% to be paid annually and the bonds have a maturity of 10 years i.e. 9 years until maturity. As per the current market trend, the bonds with similar risk profile have yielded to maturity of 6%. Calculate the market price of the bonds based on the given information. How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a ... Calculate the Coupon Rate of a Bond - YouTube This video explains how to calculate the coupon rate of a bond when you are given all of the other terms (price, maturity, par value, and YTM) with the bond ... How to Find Coupon Rate of a Bond on Financial Calculator How to Calculate Coupon Rate of a Bond On A Financial Calculator: The coupon rate is the interest that a bond pays per year, divided by the bond's face value. For example, if a bond has a face value of $1,000 and pays a coupon rate of 5%, then the bond will pay $50 in interest each year.

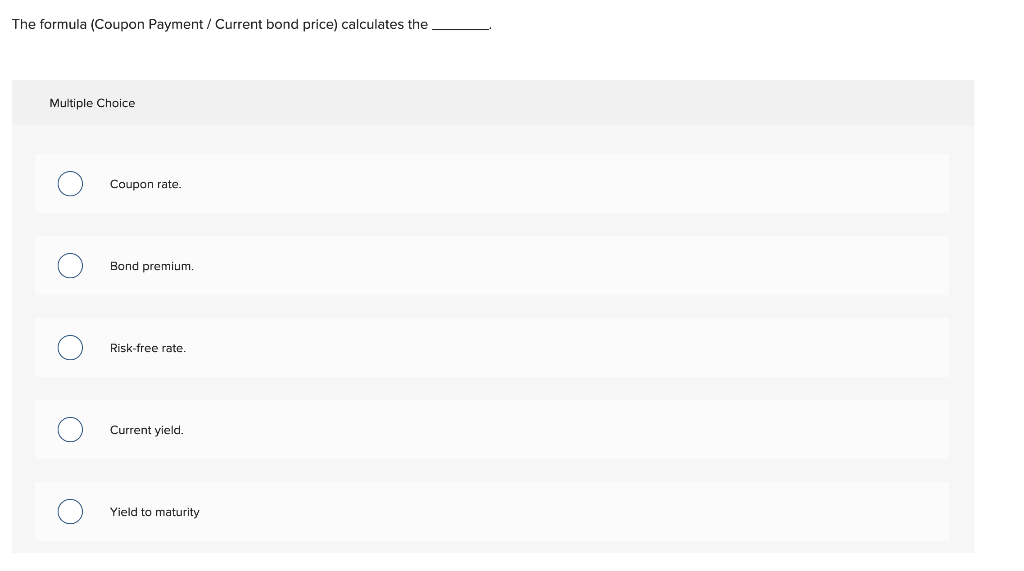

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Regardless of the direction of interest rates and their impact on the price of the bond, the coupon rate and the ... What Is a Coupon Rate? How To Calculate Them & What They're Used For A bond's coupon rate shows you how much interest the bond issuer pays the bondholder annually. Therefore, this rate is measured as a percentage of bond par value (face value). For instance, assume a $2,000 bond has a face value of $2,000 and a coupon rate of 2%, this means that $40 (that is 2% of $2,000) will be paid to the bondholder each ... What excel formula can you use to determine the yield of a bond Jan 31, 2012 · c. How to calculate the Yield to Maturity (YTM) of a bond.The equation below gives the value of a bond at time 0. The cash flows of the bond, coupon payments (CP) and Maturity Value (MV = Principal Amount + Coupon payment) have been discounted at the yield-to-maturity (YTM) rate, r, in order to determine the present value of cash flows or alternatively the price or value of the ... Calculate the price of a $1000 face value five year | Chegg.com Economics questions and answers. Calculate the price of a $1000 face value five year coupon bond when the yield to maturity is 5%, and the coupon rate is 7%. b) (5 points) Now suppose that the yield to maturity falls to 4%. Calculate the new price of this coupon bond. c) (10 points) Using the market for bonds (bond demand and bond supply), name ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link.

sjbek.ndc24.pl rate. t = Number of years. n = Number of compounding periods of a discount rate per year. Estimating the zero coupon rate or zero rates using the bootstrap approach and with excel

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

Post a Comment for "40 how to find the coupon rate of a bond"